-

Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko

Mathematics serves as a powerful tool for scientific prediction, especially in the realm of finance and cryptocurrency valuation. While it’s essential to acknowledge that mathematical predictions are not infallible and provide no guarantees in the volatile world of crypto, employing math models can significantly enhance the confidence of traders and investors. These models offer a… Read more

Proven by PhDs in Economics and Computer Science

Math Bitcoin Predictions

Math Bitcoin Predictions

Table of Contents

This site is dedicated to mathematical Bitcoin predictions — the name speaks for itself. I launched this website following the publication of my book, Math Bitcoin Price Predictions: 2030, 2040, 2050, on Amazon. While the site may not have extensive information yet, I am committed to continually updating and expanding it.

BTC Price Prediction: Critical Factors to Consider

What factors do I consider in my math when making each individual BTC price prediction? Here, are the key pillars I take into account:

- Market Capitalization: Analyzing changes in Bitcoin’s market cap can reveal trends that may influence future prices. Comparisons with traditional assets like gold, silver, and stocks from S&P 500 provide valuable context for Bitcoin’s valuation.

- Inflation: Analyzing the impact of inflation on the value of the dollar also provides valuable insights into the worth of various assets, including Bitcoin, that can be purchased with dollars, especially over the course of several years or decades.

- Supply and Demand Dynamics: The fundamental economic principle of supply and demand significantly influences Bitcoin’s price. The greater the demand from bullish investors looking to purchase Bitcoin, the higher its price rises.

- Regulatory Environment: Changes in regulations can impact market confidence and investor behavior. Monitoring legislative developments is crucial for understanding potential price movements.

Of course, this amount of work requires a significant amount of time. That is why I focus on long-term forecasting rather than short-term. Price movements within a single month are often deceptive and therefore unreliable. I am more interested in maximum Bitcoin prices over the course of a year, as this is easier to calculate mathematically and thus more reliable.

Bitcoin Price Prediction: 2030, 2040, 2050 — in Prediction 2

There are many opinions on the internet regarding the price of Bitcoin in 2030 and 2040, and many people are also curious about its price in 2050. But who can say for sure how the future will unfold? I can’t. And I won’t. I honestly want to emphasize that my views are based on mathematics, not on speculation. In my book, you will find 28 predictions. Here, in the concise Table 1, I present Prediction 2 for the specific years — 2030, 2040, and 2050:

| Year | Prediction 2 |

|---|---|

| 2030 | $152,000 |

| 2040 | $281,000 |

| 2050 | $526,000 |

(Prediction 2)

Prediction 1 also has a chance of coming true, just like many other predictions. Here, I present the estimated years for your reference without going into too much detail. However, I would like to point out that Prediction 1 uses an inflation rate of 4.9% (the average over the last 30 years), while Prediction 2 uses an inflation rate of 6.5% (the average over the last 80 years).

How High Will Bitcoin Go: Will It Reach 1 Million and 1 Billion?

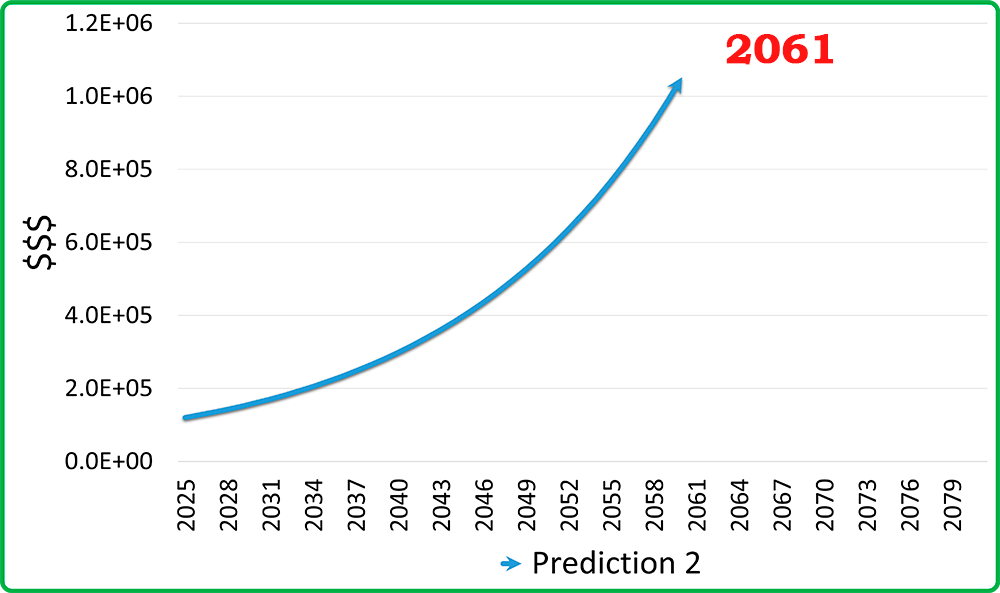

Figure 1 shows the graph. According to Prediction 2, the price of $1 million USD per 1 BTC is expected to be reached in 2061. This graph is plotted using the data from Table 2, where I have listed the maximum Bitcoin prices in U.S. dollars derived from my calculations in my book.

Table 2 (click to expand)

| Year | Maximum BTC Price in USD |

|---|---|

| 2024 | $108,353 |

| 2025 | $114,356 |

| 2026 | $120,703 |

| 2027 | $127,591 |

| 2028 | $135,074 |

| 2029 | $143,103 |

| 2030 | $151,722 |

| 2031 | $160,980 |

| 2032 | $171,033 |

| 2033 | $181,769 |

| 2034 | $193,236 |

| 2035 | $205,488 |

| 2036 | $218,668 |

| 2037 | $232,717 |

| 2038 | $247,693 |

| 2039 | $263,660 |

| 2040 | $280,721 |

| 2041 | $298,897 |

| 2042 | $318,260 |

| 2043 | $338,889 |

| 2044 | $360,884 |

| 2045 | $384,310 |

| 2046 | $409,262 |

| 2047 | $435,839 |

| 2048 | $464,154 |

| 2049 | $494,311 |

| 2050 | $526,429 |

| 2051 | $560,636 |

| 2052 | $597,071 |

| 2053 | $635,875 |

| 2054 | $677,201 |

| 2055 | $721,215 |

| 2056 | $768,091 |

| 2057 | $818,014 |

| 2058 | $871,183 |

| 2059 | $927,808 |

| 2060 | $988,114 |

| 2061 | $1,052,340 |

per bitcoin by 2061

According to this prediction, the price of Bitcoin is expected to reach 1 million dollars in 2061. I’m not claiming this will definitely happen; I’m simply stating that, based on the given mathematical conditions, the price could reach that level by 2061. To better understand my calculations, I recommend reading my book. And if you haven’t decided yet, check out the detailed review of Math Bitcoin Price Predictions: 2030, 2040, 2050.

Why Bitcoin Price Predictions Matter?

I think you know why Bitcoin price predictions are important for you. Otherwise, why else do you Google them? However, I would like to highlight a few key points that underscore the importance for me of having reliable forecasts:

- Managing Expectations: Bitcoin price predictions help me establish realistic targets for potential profits. Given the well-known volatility of the cryptocurrency, informed forecasts enable me to formulate effective buy or sell strategies and gauge my bullish or bearish sentiment.

- Assessing Risks: Price forecasting helps me assess the risks associated with my investments. You would agree that having an idea of the potential price ceiling (even if it’s not entirely accurate) for the current year significantly reduces risk.

- Informed Decision-Making: Reliable forecasts serve as a basis for making informed decisions in unpredictable market conditions. As a result, I can choose better timing for opening and closing positions and plan my portfolio more thoughtfully.

- Enhancing Financial Success: Ultimately, well-founded price forecasts play an important role in profiting from the inherent volatility of the cryptocurrency market. By interpreting these forecasts, I can effectively navigate the complexities and align my strategies with market realities.

Understanding bitcoin price predictions requires an analytical mindset. By using mathematical models and comprehensive analysis, you can gain valuable insights into the future of bitcoin. While predictions are not infallible, they can significantly enhance decision-making in an unpredictable market.

As the cryptocurrency landscape continues to evolve, awareness of potential price movements will remain a key component of successful bitcoin investing. A data-driven approach will allow you, me, and all stakeholders to navigate the complexities of the market with greater confidence and foresight. Additionally, it will help keep your investments safe. If you and I share the same vision of the importance of predictions, then welcome aboard!