Table of Contents

Mathematics serves as a powerful tool for scientific prediction, especially in the realm of finance and cryptocurrency valuation. While it’s essential to acknowledge that mathematical predictions are not infallible and provide no guarantees in the volatile world of crypto, employing math models can significantly enhance the confidence of traders and investors. These models offer a structured approach to decision-making, enabling individuals to navigate the chaos and uncertainty inherent in the market. Math Bitcoin Price Prediction: 2030, 2040, 2050 is a book that contains logically sound and mathematically calculated Bitcoin projections.

Changes in the Second Edition of the Book

On January 19, 2025, the second edition of the book was published. It contains very important changes, as the calculations are now based on data for the entire year of 2024, not just its first half. The changes include:

- The maximum relative Bitcoin market capitalization for 2024 is now 7.2% of the US GDP.

- The maximum absolute Bitcoin market capitalization for 2024 is now 2.15 trillion dollars.

- The Inflation, Gold, Silver, S&P500, and Bitcoin Corridors have been revised.

- Both forecast Wings have been adjusted.

The Amazon team did not apply the second edition label to the book, although I had set it. In my opinion, the changes are quite significant, as the sudden surge in Bitcoin’s price at the end of 2024 to $108,353 (according to Binance data) notably altered the forecasts. Yes, Trump’s election had affected the price of Bitcoin – that’s a fact. This required some recalculations, but no further recalculations will be made. The year 2024 is now the fixed basis for all other projections in the book. If you haven’t yet read the preview, please click the button below:

The Importance of Bitcoin Price Predictions

The primary aim of this study is to forecast Bitcoin prices for the upcoming decades, specifically the 2030s, 2040s, 2050s, and beyond. This analysis is designed to equip readers with insights that could not only help them save money but also adjust their expectations regarding potential fluctuations in Bitcoin’s value — the first and most recognized cryptocurrency. Math Bitcoin Price Prediction: 2030, 2040, 2050 is a study that will make your expectations about the Bitcoin price movement more realistic and reasonable.

Throughout the study, maximum annual Bitcoin prices in USD will be projected, and the likely timing of significant milestones such as $1 million and even $1 billion will be determined. This comprehensive analysis will be invaluable to a wide array of stakeholders, including crypto traders, Bitcoin holders, and anyone else interested in the cryptocurrency market.

Throughout the book, readers will find mathematically grounded answers to several pressing questions that many investors are eager to explore. These include inquiries such as:

- What is the possible Bitcoin future?

- Is it likely that Bitcoin will go up?

- What is the potential maximum value that Bitcoin could achieve, or how high can Bitcoin go?

- How high is Bitcoin expected to rise in the coming years, or how high will Bitcoin go?

- Will Bitcoin eventually hit the monumental benchmarks of $1 million and $1 billion?

- When will these significant price points likely be reached?

- What are the projected Bitcoin prices for the years 2030, 2040, and 2050?

Comprehensive Bitcoin Predictions and Mathematical Basis

This research does not provide just one BTC price prediction; instead, it offers a total of 28 distinct predictions, each grounded in rigorous mathematical calculations based on specific conditions. The analysis draws upon changes in the market capitalizations of Bitcoin, gold, silver, and stocks from the S&P 500 index. Readers can anticipate a thorough exploration of this data, crafted by a Ukrainian author who holds a Master’s degree in Biophysics. The writing is designed to be accessible and engaging, avoiding complex mathematical jargon in favor of a clear and straightforward presentation that anyone can understand.

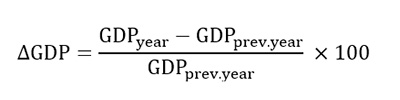

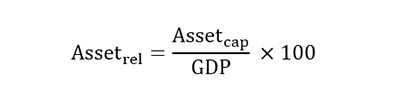

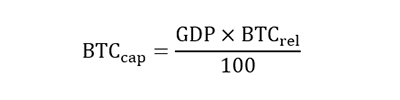

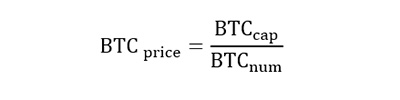

Formulas Used for Bitcoin Projections

The formulas employed are part of the high school mathematics curriculum, ensuring that the methodology is not only versatile but also empowering for readers who wish to conduct their own Bitcoin projections or even other crypto forecasts in the years ahead. So, the following formulas are used in the book:

In the book, comprehensive descriptions of the application of these formulas are provided. You can review them yourself as they are available in the free preview on Amazon.

Data Analysis and Bitcoin Price Forecasting to $1M and $1B

In the book, you will find a wealth of information presented in various formats:

- 24 detailed tables that break down the predictions.

- 12 concise tables for quick reference.

- 16 illustrative figures that visually represent key concepts.

- 5 fundamental formulas that underpin the predictions.

Below is the sample Table 1 showcasing the mathematical results related to Bitcoin price predictions:

| Year | Prediction 1 | Prediction 2 |

|---|---|---|

| 2030 | $138,000 | $152,000 |

| 2040 | $219,000 | $281,000 |

| 2050 | $353,000 | $526,000 |

| 2061 | .. | $1,000,000 |

| 2072 | $1,000,000 | .. |

| 2170 | .. | $1,000,000,000 |

| 2218 | $1,000,000,000 | .. |

Predictions 1 and 2

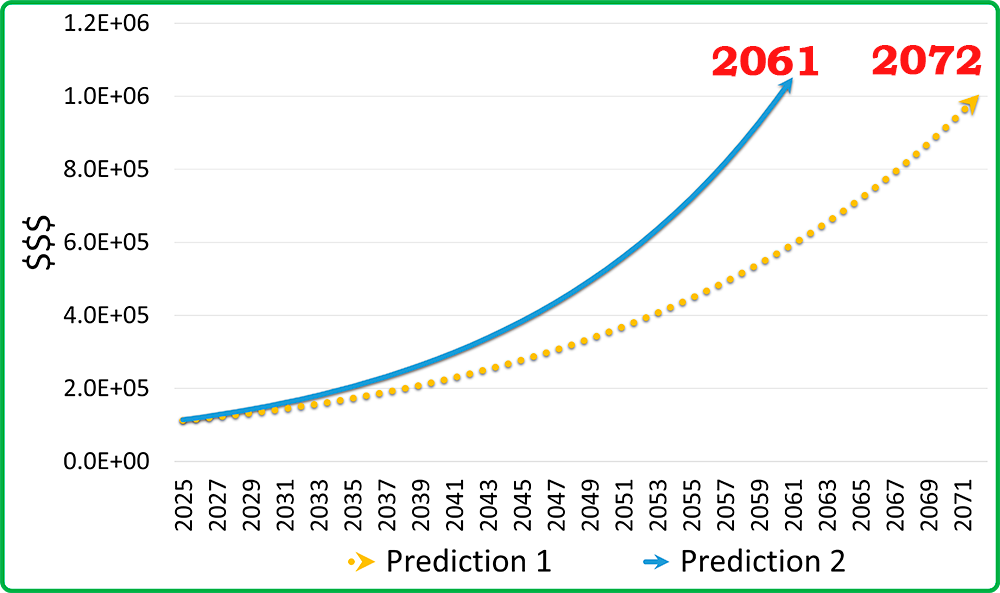

The data in this table is obtained using several formulas. There will be no explanation for the formulas here, as they are provided in the book. Large tables have 6-8 columns each, so you will be able to understand the calculations at each step. Below, I suggest you take a look at the Figure 2 — there are 16 such figures in the book.

This figure shows two curves that correspond to Predictions 1 and 2. Their arrows point to the years when Bitcoin could reach a price of 1 million. I call this chart the Inflation Corridor because it is based on data regarding changes in inflation. I also consider Demand Corridors and Demand and Inflation Wings in the book. There are a total of 28 Bitcoin price predictions, each accompanied by a chart and a table.

This study aims to provide a clear, thorough, and mathematically grounded perspective on Bitcoin’s future. For those who wish to delve deeper into the methodologies, predictions, and analyses, I encourage you to read Math Bitcoin Price Prediction: 2030, 2040, 2050 on KDP on Amazon (ASIN: B0DHV5TVYG), where you’ll find all the details needed to understand the intricacies of these Bitcoin forecasts.

So, is it worth reading?

The text is infused with an approachable tone, making the reading experience enjoyable, even if some sections are inherently challenging due to the complexity of the subject matter. The calculated figures presented will lead readers to the compelling conclusion that reaching $1,000,000 per bitcoin is inevitable, at least due to the effects of inflation over time.

However, I posit that the actual Bitcoin price predictions for 2030, 2040, and 2050 may not be as astronomically high as some might anticipate. This nuanced view is firmly backed by logic and a wealth of factual evidence, making the findings all the more credible.

There are no glib claims in this book about Bitcoin quickly reaching a price of 1 million dollars. And if you’re looking for them, you won’t find any. What you will find in this book are mathematical calculations of Bitcoin’s possible paths. And I believe you will see the price ceiling of Bitcoin as I saw it.

Have you already decided whether you want to read this book or not? If you haven’t made up your mind yet, the following section contains scholarly reviews of the book. I hope it will help you decide.

Independent Reviews of the Book

This section contains reviews from those who have already read my book. Their opinions help to understand how my research is perceived and the value it brings. All reviews are genuine. Under each review, you will find a link to the person’s LinkedIn profile where the review is also posted.

Scientific Review #1

In the book Math Bitcoin Price Prediction: 2030, 2040, 2050, the author explores the long-term prospects of Bitcoin. Today, the future of the Bitcoin market is fraught with uncertainties: some experts believe it will become digital gold and serve as a store of value, while others think it will emerge as a primary means of payment in the future. In any case, the high interest in Bitcoin underscores the relevance of this study.

The material in the book is clearly structured and logically presented, with a writing style that is easy, simple, and accessible for readers with varying levels of financial and mathematical background, enriched with examples and analogies. Readers shouldn’t be intimidated by the author’s emphasis on mathematics; it is indispensable in financial operations and forecasts. Here, the author deserves credit for presenting explanations, justifications, and mathematical calculations that are quite straightforward and comprehensible. All terminology is well-known, clear, and accessible.

Why do I think this book is worth reading?

- The questions raised in the book are relevant today and will remain so in 10-20 years or more.

- The author masterfully articulates the essence of his ideas and builds forecasts based on simple and comprehensible categories, terms, and concepts.

- The book prompts reflection and leaves room for personal thoughts, calculations, and predictions.

- It will certainly engage readers, regardless of whether they agree with the author’s forecasts or believe in them.

Who will enjoy this book?

- Primarily, of course, crypto traders and holders, to whom the author addresses it.

- Anyone interested in alternative financial investments.

- Those who want to delve into the cryptocurrency market and find answers to their questions in straightforward language, supported by relevant analytical calculations and forecasts.

Overall, the book is original, offering an intriguing perspective on a pressing contemporary issue — Bitcoin — and possesses undeniable practical value.

Scientific Review #2

Math Bitcoin Price Prediction: 2030, 2040, 2050 is a well-organized book with content that is both structured and engaging, making it very comfortable to read. The author dives into a fascinating and highly relevant topic — Bitcoin price predictions in the coming decades. As the cryptocurrency market continues to grow in popularity, more people are seeking to understand the dynamics behind it, and Bitcoin, as the most well-known cryptocurrency, naturally draws much of this interest.

What sets this book apart is the author’s logical argumentation and transparent methodology. Detailed explanations of data sources highlight the significant effort invested in researching and presenting the material, especially given the complexities of the subject. While some of the assumptions made by the author may be debatable, the transparency of the data allows readers to critically engage with these hypotheses.

One of the strengths of the book is that it encourages interaction. The reader is invited to experiment with the author’s predictions using the openly available data and simple calculations, allowing them to test these assumptions for themselves. This approach fosters a deeper understanding of the material and invites further discussion. In conclusion, the book not only provides thoughtful analysis but also encourages debate — a key aspect of any meaningful work. The author has delivered a valuable resource for anyone interested in cryptocurrency market dynamics and future predictions.

Short Reviews

In this section, you can read other reviews of the book. Here are the thoughts of readers who received my book and wanted to share their impressions of what they read. Next to the photo is a link to their LinkedIn profile, where you can also find their comments.

Short Review #1

The book Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko is an interesting study on long-term prediction of the future of the first cryptocurrency, yet well written for people who are hardly familiar with cryptocurrencies. The author has managed to present the theoretical basis both mathematically correct and understandable for most readers. Moreover, as a computer science researcher, I see this book as important for the technological implications in the field of blockchain and other distributed ledger technologies, once introduced to the world by bitcoin.

Andrii Kopp, LinkedIn, PhD in Computer Science, Associate Professor, Head of Software Engineering and Management Intelligent Technologies Department

Short Review #2

The monograph under review explores critical aspects of the financial world, with a particular focus on cryptocurrencies and their future projections. The author delves into the complexities of these digital assets while addressing the instability caused by external macroeconomic factors, which significantly influence the volatility and unpredictability of cryptocurrency markets.

What stands out in this work is the engaging presentation of a complex scientific and practical foundation. The author successfully employs simple financial mathematical tools to explain intricate concepts, making the material accessible to a broader audience. This approach not only enhances the comprehension of the subject but also attracts readers from various fields who may not have a strong background in finance.

Additionally, the monograph reflects the author’s personal journey, which was marked by numerous challenges. This aspect adds a unique and valuable dimension to the research, highlighting the dedication and resilience required to produce such a significant contribution to the field.

In conclusion, this work offers valuable insights into the evolving landscape of cryptocurrencies and is a notable resource for both scholars and practitioners interested in the financial market dynamics shaped by macroeconomic influences.

Maria Kutsinska, LinkedIn, PhD in Economics, Associated Professor, Analyst of Consolidated Information

Short Review #3

If you’re interested in the future of Bitcoin and want a clear, data-driven analysis, Math Bitcoin Price Prediction: 2030, 2040, 2050 is definitely worth reading. The author breaks down complex financial forecasts into easy-to-understand math, making ambitious predictions about Bitcoin reaching $1 million by 2082 and possibly $1 billion by 2229. What I appreciate most is how accessible the book is—even if you’re not a math expert, you can follow the logic. While the predictions are speculative, the methodology is solid and makes you think more critically about Bitcoin’s potential. I highly recommend this book for anyone curious about long-term crypto trends!

Lesia Samoilenko, LinkedIn, PhD in Economics, Associate Professor, Product Manager, Product Marketing Manager

Short Review #4

I really liked the way the material was presented and the style of writing. Although I am not very well-versed in cryptocurrencies, it was interesting to read about the possible future of bitcoin. My opinion may not be objective, but the calculations are quite interesting.

Maryna Mozgova, LinkedIn, PhD in Economics, Assistant Professor of Marketing, CFO